2024: Another Great Year for the US Stock Markets

2024 turned out to be another successful year for my investment account, delivering a remarkable ~63% gain. This performance significantly outpaced the broader market indices: ~25% gain in SPY (S&P 500), ~29% in COMP (Nasdaq), and ~13% in the DJIA (Dow Jones Industrial Average).

What makes this result particularly satisfying is the simplicity of the process. I didn’t spend hours analyzing financial reports or listening to endless expert opinions. Instead, I adhered to a few simple principles, which I’ve outlined previously (Covered Call 投资策略讲座, https://www.youtube.com/watch?app=desktop&v=HlwLHT2yQ7s). I focus on the “big picture” and ignore the noise and nuanced analyses.

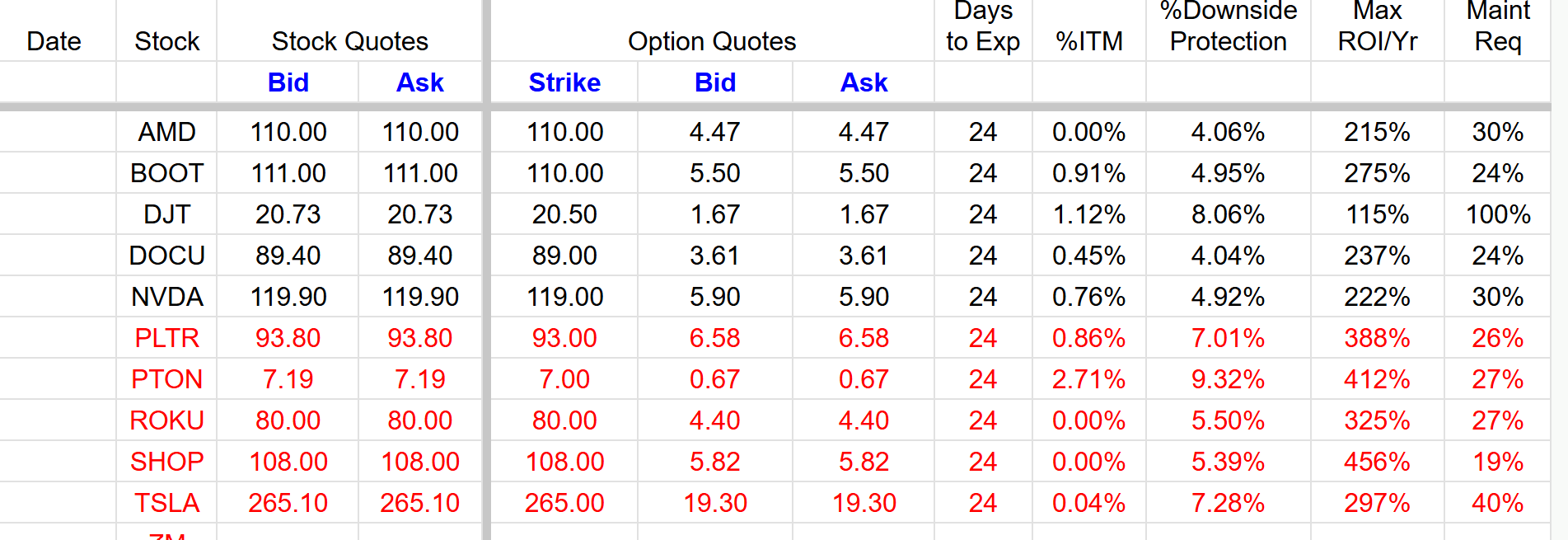

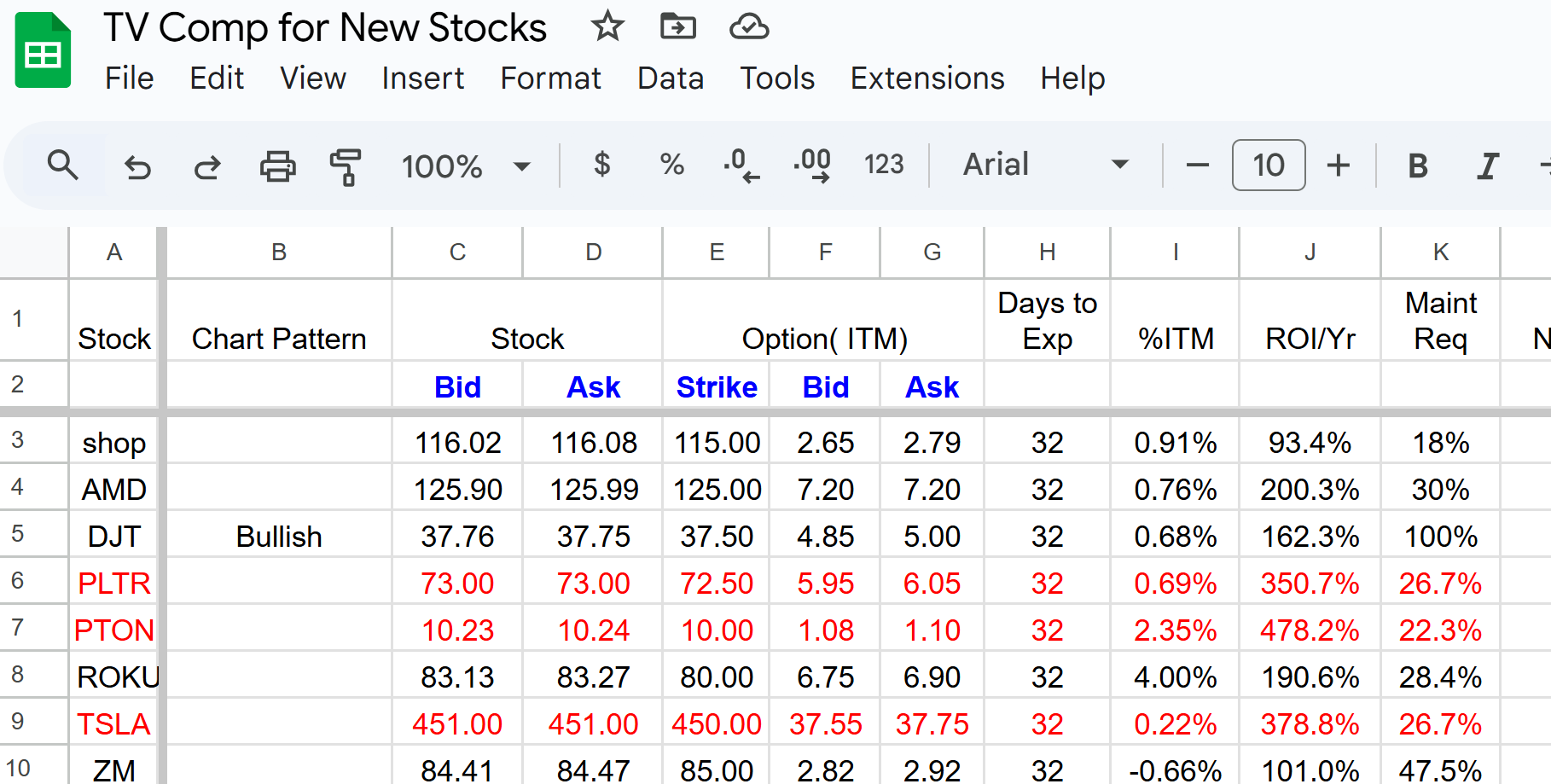

This straightforward approach has not only provided excellent returns but has also saved me considerable time. I dedicate no more than 1–2 hours a month to investment-related tasks, usually addressing expiring options or allocating new investable cash. For instance, January 17th, 2025, is an upcoming expiration date for some of my call options. I’ll need to make adjustments for those expiring positions, before Jan. 17th, 2025.

A Philosophy Shared Between Investing and Medicine

Interestingly, the way I approach investing mirrors how I view medicine and health. I focus on overarching principles and ignore excessive details and noise. This approach has proven to be both effective and efficient in managing my investments and health strategies.

A Lesson from History

About 30 years ago, while learning about investing, I came across a story about a New York man who spent an extended period in Tibet, away from stock quotes (this was before the internet era, like in the 1950s-1960s). He had purchased certain stocks and, due to his isolation, left them untouched. Upon his return, he discovered that his investments had grown significantly.

A Similar Personal Experience

This story reminds me of my own experience. Two to three years ago, I opened a Robinhood account (mainly for crypto trading and its zero fees) with a small sum of money. I bought DOGE (cryptocurrency) and a biotech stock (VKTX). Shortly after, the account’s value dropped by about 30%. Frustrated, I forgot about it completely, even the name of the trading platform.

Recently, I remembered the account, found it, and logged in. To my surprise, the account had grown by 400%! It was a pleasant discovery and reinforced the idea that sometimes, doing less yields better results.

This experience further validates my approach to investing: focus on simplicity, ignore the noise, and trust in long-term principles. Whether in investing or health, the “big picture” often holds the key to success.