One concern for the investor is when the investment runs out, there is no more income. Any assets remaining in the trust will be sold off and the trust dissolved. Important for the investor to know is how long the trust will remain, or will the income producer remain or run out? One particular trust I have written on in the past is Great Northern Ore(GNI).

GNI will terminate with the final payment in April 2015. When the trust terminates, the investors get their last check and the shares are worthless. The details are in the article, but knowing when to get out is important to a good investor.

With many commodities, another question is what are the effects on the price of goods, and how will the market affect them? Does the price go up or down? What are the many factors in the market? A simple example could be a hurricane effect on the oil producing Gulf Coast. Multiple storms through one season could drive the price way up, or damage wells belonging to the trust and cost millions in repairs. All of these are unknown future effects.

With many investments, trusts are evaluated daily in the market and bought and sold based on the perceived value. A trust with a higher rate of return may be signaling that the investment has some issues. In my opinion, a 10% return on your investment per year is good. Those that provide a higher rate sometimes indicate risk. Buyers would bid the price up if it were a great buy. The higher rates are not bad, but most should be seen for what type of investment they really are. Many trusts are smaller entities, with little to no ability to react and adjust their business operations because of the requirements written into the trust.

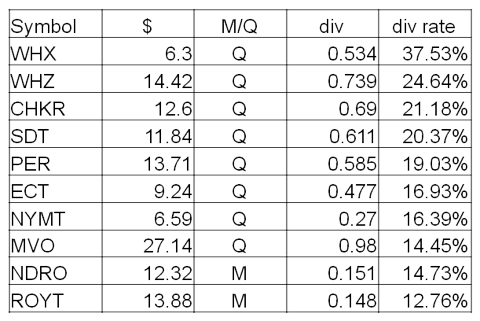

I have selected several trusts to highlight in this article and will write follow up articles as available. Trusts included here are WHX, WHZ, andCHKR, with SDT, PER, ECT, NYMT, MVO, NDRO AND ROYT displayed in the chart as other trusts with interests. In the chart I cover some basic information investors want to know.

Whiting USA Trust I (WHX) was formed in October 2007, by Whiting Petroleum Corporation. Whiting Petroleum Corporation’s wholly-owned subsidiaries, Whiting Oil and Gas Corporation and Equity Oil Company, conveyed a term net profits interest to the trust that represented the right to receive 90% of the net proceeds from Whiting’s interests in certain existing oil and natural gas producing properties. The net profits interest entitled the trust to receive 90% of the net proceeds from the sale of production of 9.11 million barrels of oil equivalent (MMBOE), which is equivalent to 8.20 MMBOE attributable to the net profits interest, after which the trust will terminate. In the company quarterly report, as of September 30, 2013 on a cumulative accrual basis, 6.86 MMBOE (84%) of the Trust’s total 8.20 MMBOE have been produced and sold (of which proceeds from the sale of 260 MBOE, which is 90% of 288 MBOE, will be distributed to unitholders in the Trust’s forthcoming November 2013 distribution) and a cumulative reserve quantity of 0.02 MMBOE have been divested. The remaining reserve quantities are projected to be produced by June 30, 2015, based on the reserve report for the underlying properties as of December 31, 2012.

At the currently estimated end date of Jun 2015, the trust will pay 7 more dividends. The last dividend was $0.534, making the estimated total payout of $3.73 until the termination of the trust. With the stock price at $6.30 today during midday trading, I would look to this stock as overpriced and stay clear of this investment. The price should decrease every quarter until June 2015, when it should reach zero. To buy in, the price would need to be $3.00 or below to get my initial capital back with a 10% return.