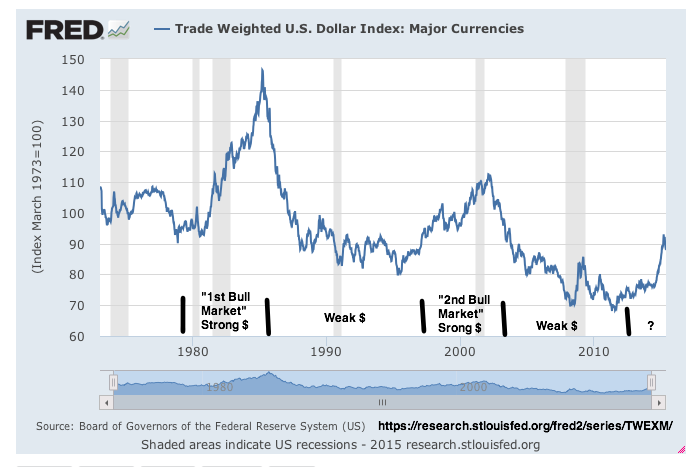

There has been an observation, in the Chinese media, that US Dollar Index (USDX) follows a 10-year weak dollar period followed by a 6-year strong dollar period, at least 2 such cycles have been seen (from early 70s – ’86, weak $, followed by ’86 -’92, strong $. And from ’87 – ’97, weak $, followed by ’97 – ’02, strong $. The 3rd cycle: ’02 – ’12, weak $, ’12 – ’18, strong $?). If this observation holds true for the third cycle, there is more fuel left in the current bull market has until 2018, that’s about 3 more years of bull market.

Menu

Calendar

February 2026 M T W T F S S « Mar 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Search This Blog

Archives

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- March 2022

- April 2017

- June 2015

- May 2015

- April 2015

- March 2014

- February 2014

- January 2014

- November 2013

- September 2013

- August 2013

- May 2013

- April 2013

- March 2013

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

Pages

Meta