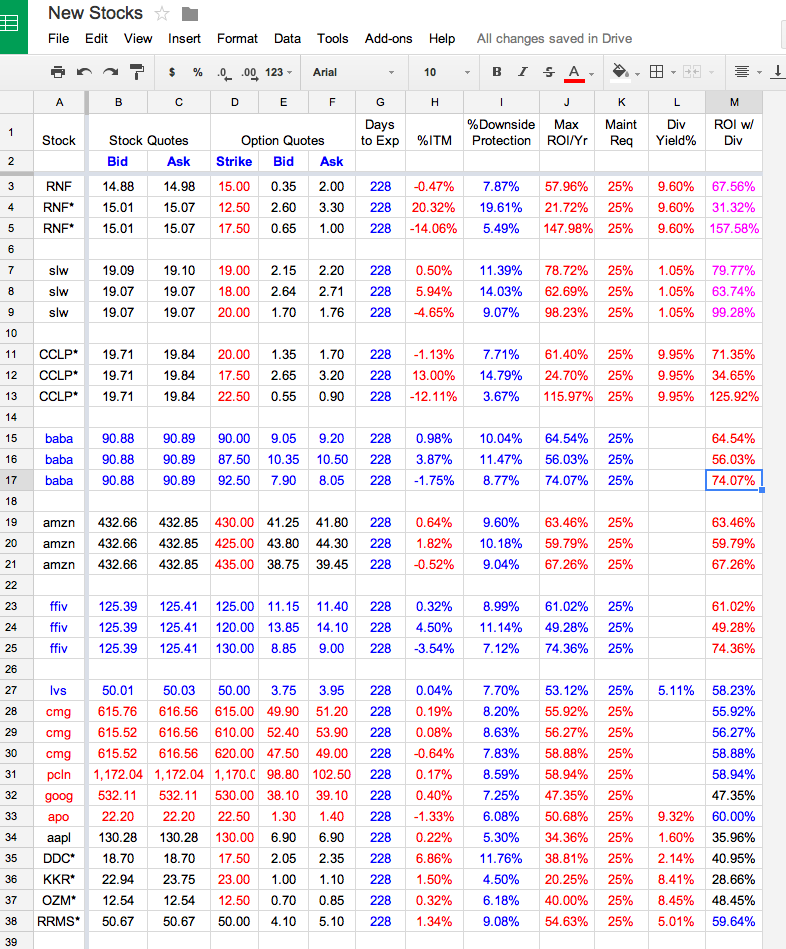

Here is how I select stocks to invest. Combining the stocks I traded or still hold with the new candidates by screening, I came up with a list of 16 stocks (I usually adjust the screening criteria to provide a manageable list of 15-20).

The stocks that are of high ROI are listed on top of the table with 3 different strikes: ATM, ITM and OTM, for comparison. There are a total of 6 such stocks to consider.

From Row 27 and down are list of stocks still with great but lower ROI.

Column M is the sum of ROI of the covered call + dividend yield.

*Stocks in capital letters with * are new candidates of my screening result with the following criteria: Div yield>5%, Beta>1, Price above 50 and 200 SMA, Sales growth over the past 5 years: >15%, optionable and the RSI is not overbought.

A bit more detailed analysis of 3 stocks of the top 6 will be provided separately.